(click to enlarge)

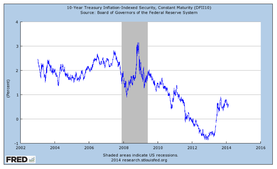

(click to enlarge) Rising real (inflation-adjusted) interest rates are a key factor driving investment decisions. Businesses want to invest when they expect that the return on investment will exceed the real cost of money. Since the last recession, the pace of business investment has lagged what we would normally see in a recovery, even though real interest rates have been low or even negative.

But since last summer, the rise in long-term interest rates combined with falling inflation lifted real rates from negative to positive. In our opinion, rates aren't high enough to inhibit business investment, but the pace of increase should be watched.

Depending on which inflation measure you choose, real rates are within about 50 basis points of the long-term average. A basis point is one-hundredth of a percentage point. From 2003-2006, when the economy and markets appeared to have found an equilibrium, the average was about 2% using the core Consumer Price Index (which excludes food and energy prices), so there is still some room to run.

A return to "normal" would probably be in the 2% to 2.5% region since that was the average for years prior to the financial crisis when the economy and markets seemed to reach equilibrium. If that is hit or exceeded early in the year, it would probably be a signal that long-term rates have peaked for the time being, and the curve would flatten. At some point, when Fed policy shifts, short-term rates will need to rise, but that will probably be a 2015 event. Sua Sponte

Bradford C. Bruner for Sua Sponte Wealth Management

But since last summer, the rise in long-term interest rates combined with falling inflation lifted real rates from negative to positive. In our opinion, rates aren't high enough to inhibit business investment, but the pace of increase should be watched.

Depending on which inflation measure you choose, real rates are within about 50 basis points of the long-term average. A basis point is one-hundredth of a percentage point. From 2003-2006, when the economy and markets appeared to have found an equilibrium, the average was about 2% using the core Consumer Price Index (which excludes food and energy prices), so there is still some room to run.

A return to "normal" would probably be in the 2% to 2.5% region since that was the average for years prior to the financial crisis when the economy and markets seemed to reach equilibrium. If that is hit or exceeded early in the year, it would probably be a signal that long-term rates have peaked for the time being, and the curve would flatten. At some point, when Fed policy shifts, short-term rates will need to rise, but that will probably be a 2015 event. Sua Sponte

Bradford C. Bruner for Sua Sponte Wealth Management