Highlights from the Conference, but you'll want to flip through the Charts

|

|

|

| ||||

Bradford C. Bruner for Sua Sponte Wealth Management

|

|

Highlights from the Conference, but you'll want to flip through the Charts

Bradford C. Bruner for Sua Sponte Wealth Management

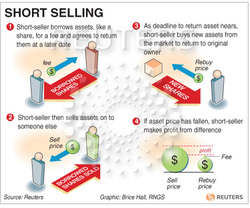

At SSWM, we like to monitor the opening bell. It is good to see how the markets react to any overnight geopolitical events, economic data reports, or yesterday's after the bell earnings releases. Lots can take place between 7:30 am and 2:00 pm MTN and it is a good idea to spend 15 minutes before and after the bell evaluating the days activity and the impact that it may have on your holdings and strategy. So what is the worst thing that can happen before the bell? Congress announces that Obama is a psychopath and they will refuse to work with him in the coming session? Bernie Ebbers has been released from jail and he is getting his team back together in an effort to consolidate wireless carriers? The world missed it, it wasn't Ebola that was a threat to the globe, it's the newly mutated Ebola II? That your student loan interest rate has been increased by 2% on money that the student loan administration receives for free and then lends to you at a criminal rate? No, it's that one of your equity holdings has been targeted by the short selling machine of media manipulators and inside traders. What is short selling? It is a bet that equity shares that a trader has borrowed (yes, they do not even pay for them) will decrease in value. Really not much of a bet but a calculated scheme. Borrow a bunch of shares <> sell those shares to someone else <> inform your insiders to sell at the close (high) <> leak to the markets of your impending report release <> release fabricated negative data <> stock tanks <> short seller buys shares at the bottom <> short seller returns borrowed shares <> profit is the margin between the high and the low market manipulated share price. Short sellers, and those trading on the inside information, can also buy on the 'panic dip' and sell when the stock returns to fair value.  From the Spruce Point Website - How a Short makes money: You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. Such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein. As part of its strategy, Spruce Point floated a 140 plus page 'opinion' report. The rumor was circulated on Wednesday near the close of trading, then the fiction was released after the close. Gripping headlines read, Spruce Point is pleased to release a 140+ page investment research opinion on AMETEK Inc. (NYSE: AME) an S&P 500 Company with a 'Strong Sell' opinion and a $27- $36 price target, or 30 - 50% Downside. My god, it's the end of the world as we know it. Only two internet feeds picked up the trash, but it was enough to ignite the fire.

What a living nightmare. Fear runs like wildfire as you have flashbacks of Bernie Ebbers, Joe Nachio, Jack Grubman, and Arthur Anderson. Was it a possible repeat scenario where the CEO is colluding with the analyst who are both backed by a corrupt accounting firm? Could the company that you saw value in be a total scam? Could you lose all of the value that you work so hard to secure? Sure, we always say that there is a thin line between perception and reality. Greed is powerful, fear is paralyzing. Well, it worked. Fear gripped the shares, they tanked. Shorts and insiders profit by more than 8%, not including client fees and other insider profits and charges. Shares recovered and we move into a new week with a new company for Spruce Point to target.  They call it activist investing. Are they really out to benefit our fellow man and the investment community or just another market manipulator arsonist profiting from starting a fire and then playing hero as they call in the alarm? We'll be watching next time they yell fire in a theater. Will you be looking to rush in and grab some free popcorn and candy? 8% plus gain in one day is not too bad. Sua Sponte. Bradford C. Bruner for Sua Sponte Wealth Management |

Sponsors - Contributors

|

||||||||||||||||