2013 looks like it will be a record year for markets. The S&P appears to be on track for a 30% gain (click chart below). The best year since 1997. The momentum has continued, in the final weeks of the year, based on improved numbers on GDP. It was as if, overnight, the financial markets realized that things may indeed be improving. We were surprised by the revision to Q3 GDP from 2% to 3.6%. A month ago we would have thought the growth would have been 1% at best.

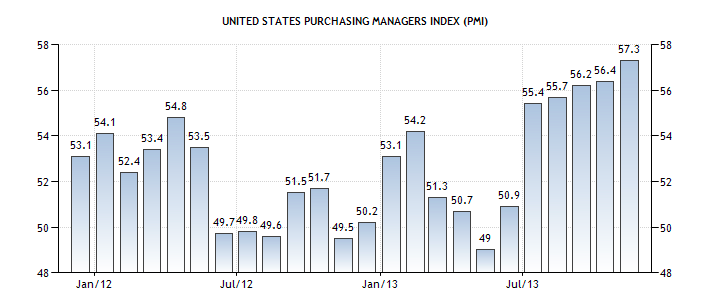

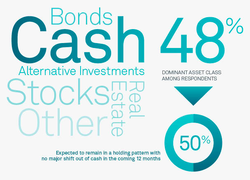

It just goes to show how fickle this economy is. The adjustment to GDP pushed the 10-year Treasury over the psychological 3% mark (click chart below). Jobless claims fell, personal spending and durable goods orders were up. While the world revels in New Year's festivities, keep an eye on the final portion of December. Consumer confidence (Tuesday) will be a key gauge of how we feel about Q4 and an indicator of optimism going into 2014. ISM manufacturing data and weekly jobless claims (Thursday) will be key points to watch. Watch the ISM at around 57, same as it was in November (click chart below). This will be a strong signal of economic expansion. Bernanke will be in front of the American Educational Association, in Philadelphia, where he should make himself available to answer questions from economists. We do feel the Fed has done as much as it can, we did avoid the possibility of a 1930s style economic fiasco that could have made the worldwide economic meltdown much worse. It all depends on fiscal policy now. Corporations are expecting more cooperation from the Government before their confidence improves (click chart below).

It just goes to show how fickle this economy is. The adjustment to GDP pushed the 10-year Treasury over the psychological 3% mark (click chart below). Jobless claims fell, personal spending and durable goods orders were up. While the world revels in New Year's festivities, keep an eye on the final portion of December. Consumer confidence (Tuesday) will be a key gauge of how we feel about Q4 and an indicator of optimism going into 2014. ISM manufacturing data and weekly jobless claims (Thursday) will be key points to watch. Watch the ISM at around 57, same as it was in November (click chart below). This will be a strong signal of economic expansion. Bernanke will be in front of the American Educational Association, in Philadelphia, where he should make himself available to answer questions from economists. We do feel the Fed has done as much as it can, we did avoid the possibility of a 1930s style economic fiasco that could have made the worldwide economic meltdown much worse. It all depends on fiscal policy now. Corporations are expecting more cooperation from the Government before their confidence improves (click chart below).

The market has had a mind of its own. When the Fed announced that it was going to ease on its bond buying the market continued its historic rise. As we continue to pull the life support tubes off our patient, we will see if it has legs of its own. Expect some wild swings that will come with additional anticipated easing. It's critical that we see a transition from stabilization to sustainable recovery.

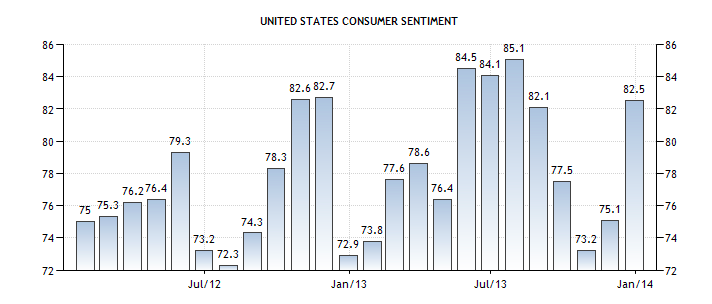

It is still a very fragile recovery. The Fed appears ready to plug us back in at any time. Corporations will continue to exploit human capital and push productivity to the maximum. If the dam breaks, and companies start to hire out of necessity, we hope that it becomes more of an employee's market with companies battling for quality labor putting those hoards of cash to use. Hiring, stable to increased wages, consumer confidence (click chart below), spending, this is what will encourage the growth engine. Fear and greed will be the brakes.

It is still a very fragile recovery. The Fed appears ready to plug us back in at any time. Corporations will continue to exploit human capital and push productivity to the maximum. If the dam breaks, and companies start to hire out of necessity, we hope that it becomes more of an employee's market with companies battling for quality labor putting those hoards of cash to use. Hiring, stable to increased wages, consumer confidence (click chart below), spending, this is what will encourage the growth engine. Fear and greed will be the brakes.

The SSWM crystal ball shows:

Unemployment improving to finish at 6.5%. Mostly a psychological benchmark that is more a result of the number leveling out by itself. Long term unemployment, wage freezes, and participation will continue to plague us. Still much pain in the job market. Our concern is that the participation rate and job quality will not see a significant improvement. Companies will continue with technological improvements and cost cutting efforts well into the second half of 2014.

GDP will be just under 3%. Lower oil prices, increased net worth (wealth effect) and an improving international economy will all contribute to more sustainable growth. The Fed has done their part and it will be up to fiscal policy now. We just hope the Government doesn't screw it up. The key will be our ability to judge the economy based on core indicators and less on 'puppet hands'.

Housing will continue to slug its way forward (click chart below). Expect the 30-year rate to rise to 5%. Prices and sales will continue to rise. We do see the divide between those who should take advantage of continued low rates, and those who can, to widen because of tighter credit restrictions and prequalification requirements. Starts and sales will be at the higher end of the market.

Inflation will be 1.9% driven by lower oil and energy prices.

S&P will finish 2014 at just over 2,000, an increase of 9%. Expect multiple corrections, along the way, that will erode by 7%, but still a strong finish. Corporations will need to prove that they are worth the current 20 PE multiple. SSWM is more comfortable at 12 to 14. 20 presents a fair amount of risk for correction if earnings disappoint. Quarterly earnings, and guidance, will be met with much anxiety and trepidation.

Expect at least one catastrophic event in 2014 that will rock the markets. Flash crash/technological espionage, terrorist event, or political stalemate is sure to occur. Timing is unknown. We will recover and forge ahead.

Unemployment improving to finish at 6.5%. Mostly a psychological benchmark that is more a result of the number leveling out by itself. Long term unemployment, wage freezes, and participation will continue to plague us. Still much pain in the job market. Our concern is that the participation rate and job quality will not see a significant improvement. Companies will continue with technological improvements and cost cutting efforts well into the second half of 2014.

GDP will be just under 3%. Lower oil prices, increased net worth (wealth effect) and an improving international economy will all contribute to more sustainable growth. The Fed has done their part and it will be up to fiscal policy now. We just hope the Government doesn't screw it up. The key will be our ability to judge the economy based on core indicators and less on 'puppet hands'.

Housing will continue to slug its way forward (click chart below). Expect the 30-year rate to rise to 5%. Prices and sales will continue to rise. We do see the divide between those who should take advantage of continued low rates, and those who can, to widen because of tighter credit restrictions and prequalification requirements. Starts and sales will be at the higher end of the market.

Inflation will be 1.9% driven by lower oil and energy prices.

S&P will finish 2014 at just over 2,000, an increase of 9%. Expect multiple corrections, along the way, that will erode by 7%, but still a strong finish. Corporations will need to prove that they are worth the current 20 PE multiple. SSWM is more comfortable at 12 to 14. 20 presents a fair amount of risk for correction if earnings disappoint. Quarterly earnings, and guidance, will be met with much anxiety and trepidation.

Expect at least one catastrophic event in 2014 that will rock the markets. Flash crash/technological espionage, terrorist event, or political stalemate is sure to occur. Timing is unknown. We will recover and forge ahead.

What is your prediction? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

Bradford C. Bruner for Sua Sponte Wealth Management