Have you been planning for retirement? Making your 401K contributions, living within your means, sticking to that tight budget, managing to sock some savings away, reaping the benefits of an IPO or the graciousness of a rich uncle? Recently, a few individuals I work with have been fortunate enough to retire from their originally chosen professions. Some are in their thirties, a few in their forties, maybe a handful in their fifties, doubt that any were in their sixties. Retiring before fifty sounds like a dream, but a couple things to keep in mind. It can be scary, but you can do it.  If your financial plan has your longevity ending at ninety, you need to plan for the long-term. You really need to map out what you want to do with your days so that they do not just slip away. Distractions that end up becoming never ending projects are not what retirement is all about. Retirement should equal happiness. It should be your time. Your time to do nothing but what you want to do, and to do those things that bring you happiness. Retirement is an opportunity to think about, and doing, only that which truly makes you happy.  It’s not so much about reinventing yourself as it is about deconstructing yourself. Rediscovering the true you. For much of our lives we live for others. Your childhood is spent developing into the type of individuals your parents would like you to be. College is developing your character and skills in order to be a positive contributor in society. A large part of your life is meeting your employer’s expectations, delivering on your obligations as a parent, supporting, and meeting, the financial commitments you have chosen as the head, or partner, of your household. Retirement is a chance to forget about who you were supposed to be and to realize who you want to be.  Feeling guilty about your good fortune? Don’t. You may have been lucky in your new found situation. Remain humble, look to do good to others. Be kind and compassionate.  Your plan should have a flexible strategy of interchangeable blocks. Maybe your retirement comes at the hands of a merger or acquisition. Not necessarily forced, but a crossroad that has possibilities. Maybe it is a restructure, that may, or may not, include you. Another opportunity surfaces that looks appealing. One that possibly is not that all-consuming, which allows for semi-retirement. See it as a move from the passenger seat to the driver’s seat. You’re in control, It’s your journey now. Do set boundaries, but boundaries on property that is now yours.  Not that working sixty hour weeks, managing an impossible workload, being all things to all people, and just attempting to navigate life’s challenges is comfortable, but knowing that your routine consists of this daily regimen, can present some comfort. In retirement, don’t go back there. Break those old habits, set a new schedule, chart a new course, get on a new path, don’t look back, don’t go back to old comfortable habits. Enjoy. Be happy. Do good. Be good.

It is one of the stories I tell my children over and over again, I think they enjoyed it the first time, on the fifteenth, maybe not. By this time though, I think they understand the story behind the story. It was great to see our friend at Charles Schwab, Brad Sorenson, mention the same event in his recent article, Jazzercise, Beanie Babies...and Other Fads. On Tuesday, July 7th, 1998, the 69th Major League All-Star Game was held at Coors Field, home of the Colorado Rockies. It was to become, and remain, the highest scoring All-Star game in history. There were 21 runs on 31 hits and present were names like: Clemens, Alex Rodriguez, Barry Bonds, Mark McGwire. Those names alone can get your mind reflecting on greed, cheating, lying and steroids. Lots was happening in 1998, was it any different than any other year? I guess greed rears it's head in every year. But remember that 1998 was also the year that Bill Clinton denied he had "sexual relations" with former White House intern Monica Lewinsky. Anyway, the craze sweeping the nation in 1998 continued to be Beanie Babies. These were small stuffed animals launched by Ty Warner in 1993, later to become Ty, Inc.. Nothing really compares to this craze. Collectors saw these instruments as a means to speculate on the future value of the stuffed toys. The Beanie Babies were not carried by large stores and there was no advertising or marketing program backing the toys. In the early days, it was reported that Beanie Babies were 10% of eBay's sales. Average selling price was north of $30 each, about 6 times the retail price. Income for Ty Warner, at the peak of the 1999 bubble, was $662M, this was more than Mattel and Hasbro...combined. Like any bubble, the decline was swift, devastating, and took no prisoners or showed any compassion for greedy speculators who lost everything as the 'rare' bags of plastic pellets became worthless overnight.  "Glory" Ty Beanie Baby "Glory" Ty Beanie Baby MCI Communications in 1998, continued to make a very big push in getting its name out in public view. Sponsoring an Indy Car Racing Team who's driver was "Mad" Max Papis. They also sponsored the 1998 All-Star Home Run Derby. Jacked up batters attempt to knock, excuse me, bean bag pitches out of the park. Because I was working for MCI in Denver at the time, I was offered ONE, not two, ticket to the All-Star game. I knew that would not fly on the home front, so I offered it to an out of town member of the MCI Marketing team. Played for a patsy by (probably just trying to suck up to this corporate delegate), let's just use his initials EK, it was greed at its very best. A few years later, we learned of this twisted plot. EK had arrived in Denver, the previous Sunday night, in anticipation of getting a free ticket to the game. He was in Denver under the premise of helping to close some deals. He worked the office staff, all day Monday, with a smile and delicate intimidation. What was his ultimate agenda? Get the company to pay for his travel, get a free MCI ticket to the game, secure the much coveted Beanie Baby "Glory", of which one was given out at the gate to those attending the game, and immediately sell it on the open market. Not sure he ever helped close any deals or even called on one client.  Executed to perfection. The only heist that compares is James King and the Denver Father's Day Massacre. In and out, free and clear. Wait, sorry, James King was never convicted. To date, no one has been, and the money never recovered. EK immediately sold "Glory" on the street for a reported $350 and left town the next morning. Never an offer for a split, good bye or a thank you. As a matter of fact, MCI was sold to WorldCom, also in 1998, and EK vanished into the ether. I can only hope that EK is in a cell with Bernie. Wait, it wasn't my $350 anyway, and this lesson is worth much more than $350.  Bernie Ebbers - got 25 years Bernie Ebbers - got 25 years So, our friend Brad Sorenson at Charles Schwab sold his Beanie Baby immediately following the game. Never one for fad investing, Brad wanted to cover his game expenses and then some. In his article, he warns of fad sectors in the market. What are today's fad sectors? We won't know until the trend reverses. What segments might have fad potential? Social networks, whose income is based primarily on advertising revenue, may be just a fad. I don't understand them. Not a member, never will be. Not investing in them. I go for companies that actually make money, that have profits, and are set to sustain themselves for the long run. Last time I checked, Bernie was still in jail. "Glory" was listed on eBay at $5.99 with zero bids and the fad sector was making a comeback. Be careful, pay attention to revenue streams and profitability potential. When things become popular, use it to your advantage. Like EK, get in, get out, leave the others behind. You invested in the fad sector? What companies do you think fit that profile? I'm gearing up to tell my story for the sixteenth time. Sua Sponte. Bradford C. Bruner for Sua Sponte Wealth Management Aloha Mr. Hand. This market is fascinating, what a run. Each month, and quarter, it seems we enter uncharted territory. It's nice to look back and feel some sort of accomplishment. But just what have we accomplished? Monetary policy has pushed interest rates to lows not seen by this generation, as a result, equities have soared since the Great Recession bottom. A recent article by H. Bradlee Perry reminds us to reflect with caution and revisit the investor's classroom. Always be a Student  Researcher and Analyst

Historian

Top of the Class or Steady Performer

Be a Valuation Major

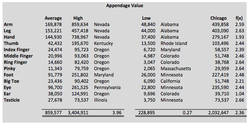

You know, it's not timing the market, it's time in the market.  Never Graduate Stay in school forever. You hear it all the time, on the sports field, at work, in life, the key - happiness. Enjoy the experience. Buy the ticket, take the ride. Be fascinated by the economy, the markets, the psychology, the history, the humor, the technology, be a sponge, enjoy the spoils. Show up for class. Aloha Spicoli.  After five seasons of viewing Shameless (Showtime), I've come to realize two things. The first, how in the name of debauchery could I recommend this series to anyone; the second, with this solid acting, directing and writing, how could I not. The show is quite entertaining. The characters are both comedy and tragedy. The anchor of the drama is Frank Gallagher. Before anything else, Frank is a scammer. He once had his kidney stolen by a cab driving surgeon. Actually, he was trying to buy a liver and he got taken. I digress. Anyway, I have long been fascinated by the value of the human life. Insurance claims, surgery (reconstruction or otherwise), youth on-field concussions, health care premiums, politics / Roe v Wade, there has to be a formula for the value of a human life. Everything in nature can be deduced to a formula. When I watch a football game on TV, I always wonder if it would be worth $10 million dollars for three years if you knew you would have double hip replacements and early onset dementia by the age of 40. What is the return on that investment or net present value of this venture? Say you had $2 million in assets. You contract Hepatitis C. The cost to keep you alive for the next 10 years is $2 million dollars, what do you do? Roll the dice, enjoy the short time, and give the remaining balance to your kids? Put them through college, make sure they stand a chance in this world? Seriously, that I just let this readership know that I actually think about finance in that way, and that I have watched Shameless, may be a point of no return.  It does make it a little easier to jot down a few notes on the subject, now that ProPublica published a thought provoking article last week. Not on the subject, but getting close. The title: How much is Your Arm Worth? Fascinating review of how each state determines its own workers' compensation benefits. Nearly every state has what’s known as a “schedule of benefits” that divides up the body like an Angus beef chart. So, your severed toe is worth $251,802 in Maryland, but only $26,000 in Minnesota. Sounds like Frank would pay the air fare and fly his toe to Maryland. Actually, he would use stolen frequent flier miles to get there....anyway. It does get difficult. The calculus can be quite dehumanizing. One worker in Alabama, lost her thumb and every finger, but her pinky, to a scrap wood conveyor. Instead of paying the larger sum for her entire hand, the mill's insurer offered her payment for each individual finger. We use only 'whole' numbers in the SSWM quest for a Total Value.  Add in the average black market price for the five major organs, liver, heart, lungs, pancreas and kidneys, total current value of the human body - $2,375,698. This is not adjusted for any harvesting fees, expenses may vary. Back to our football player. Over three years he is paid $277,778 per month for 36 months. Net Present Value based on 15% discount rate would return $5,277,336. What would you do? Sua Sponte.  Cheers Frank. Bradford C. Bruner for Sua Sponte Wealth Management  Rich uncle, IPO shares, lottery, how will you act if a windfall comes your way? How nice would it be to quit worrying about managing your finances. Think again. Any type of a 'payout' is going to take some financial management on your part. Start by taking a least 90 days before making any substantial purchases. Put the funds in a safe spot like a money market fund. This will give you some time to finalize your investment strategy and think about assembling your team of professionals. No matter how much advance thinking you have done, once the payout arrives, take the 90 days.  Make sure you review the tax implications thoroughly.

Get an estimate of taxes owed as soon as you can. Do this well in advance of tax time. Be aware that you may also be responsible for paying estimated taxes for the year in which the funds are received.  Depending on where you are in your investing life, chances are that your focus has been on building wealth. With that little extra inflow, your focus may change to wealth preservation to safe guard against dramatic market fluctuations. You may want to incorporate a little safety into your holdings. Municipal bonds may help to reduce future tax bills. Once you have it, your view of risk may change. Once you have it, you'll want to keep it.  Let your family members share in your good fortune. Think about education for everyone close to you. You’ll want to revisit (or create) your gift and estate plan to make sure you’re giving smartly. A donor-advised fund, for example, allows you to gift a large chunk of assets to qualified charities, and reap an immediate tax benefit. You can then decide how you want to allocate the donated money over time. Alternatively, a private foundation offers more flexibility in how the money is managed and donated, but also requires more paperwork. Speak to your estate planning attorney about the pros and cons of these and other charitable vehicles, as well as the best way to make gifts to family members or other individuals, if you’re so inclined.  The purpose of life insurance is to support your family should you pass away during your working years; however, if you’ve got plenty in the bank now, you may no longer need to pay those premiums. Should you buy a nicer car or home thanks to your windfall, you’ll also want to review and update your property and casualty policy. Finally, consider an extra layer of protection: Your newfound assets could make you a financial target in the event of a lawsuit. An extra liability policy, known as an umbrella policy, covers personal liabilities above the typical limits on home and auto insurance policies.  Ditching costly consumer debt (such as credit card debt) is a no-brainer. You may also want to repay student loans that offer little tax benefit. You may even be tempted to wipe out your mortgage, but that may not be the best financial move, particularly if you’ve refinanced during the recent stretch of ultra-low interest rates. A primary home loan at a 3.5% rate is equivalent to about 2.3% after taxes if your combined federal and state income tax bracket is 35% and you’re able to deduct all the interest expense. There’s a good chance you could get a higher rate of return by investing the money elsewhere. That said, don’t forget about risk. Paying off a loan is the same as earning a risk-free return equal to the cost of the money. Once you’ve taken care of the practicalities you can think about how the money might help you fund important life and career goals—a project you want to launch, for example, or the chance to explore a new direction for your retirement. Those may be the true luxuries that a windfall affords.  Once you've made some initial decisions and set aside money needed to pay taxes, consider spending a small portion of your windfall on something you'd like. There's no reason to deprive yourself, as long as you've taken care of business first. If you plan well and control the urge to spend lavishly, your windfall may provide you with financial security and comfort for many years to come. Keep you integrity and character, it got you to this point. Be yourself, help others. Bradford C. Bruner for Sua Sponte Wealth Management

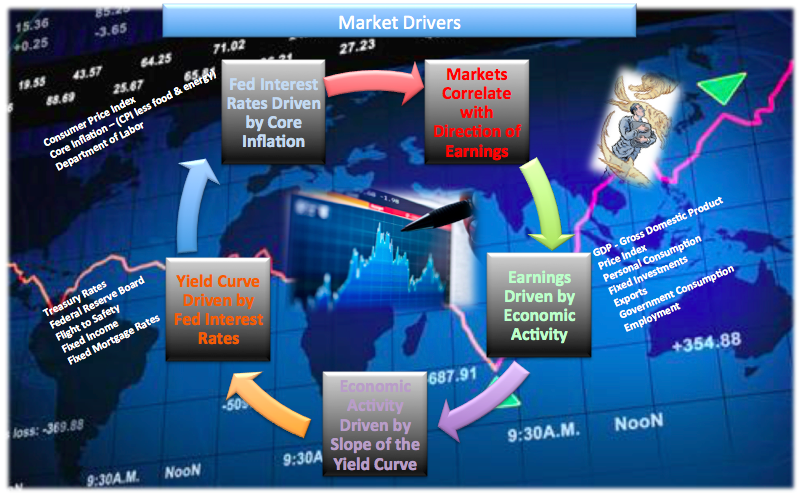

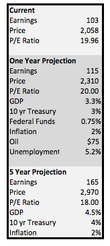

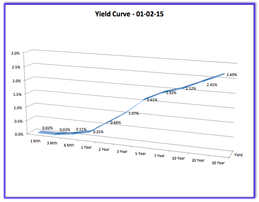

If you weren't paying attention last week, you may have missed it. Something quite dramatic took place. On Thursday, the Swiss franc was allowed to float on the market by the Swiss central bank. The euro plunged against the franc, going down by nearly 28% as the news broke. The franc had been pegged, for three years, to the European common currency (Euro) at a minimum rate of 1.20 francs to the euro. The move came as a result of the central bank chief Thomas Jordan's feeling that holding down the Swiss currency was no longer needed. A robust franc could have a dramatic impact on the country's economy. Expect the Swiss business and tourism sectors to get hammered by falling sales. The move was almost unheard of among the most widely traded currencies of advanced economies.  Swiss businesses are bracing in anticipation of plunging exports as Swiss goods become more expensive. Shoppers at home are flooding across the borders to neighboring erozone countries for cheaper goods. With the stronger franc, it will be difficult to keep the Swiss at home given the strong purchasing power just created. Foreign-exchange brokers, who had relied on the stability of the franc, were all blindsided as millions of dollars were lost around the world. The UK-based FX broker Alpari Foreign-exchange brokers and New Zealand's Excel Markets had become insolvent in a matter of minutes. Everest Capital's Global Fund is closing its largest hedge fund after losing $830 Million in assets. These will not be the last of the casualties. Great chocolate, precious timepieces, legendary bank accounts, fascinating transportation system, another economy on the rocks. Sua Sponte. Bradford C. Bruner for Sua Sponte Wealth Management  Did you know that the entire Friends series is now available on Netflix? Yes, it became available after midnight on New Year's Day. I'm glad to see that it has been well received in our family, at 22 minutes per episode (no commercials of course), it is an excellent value in the humor sector. About the only other rerun worth watching this year will be the year itself. We see a replay of 2014 in the 2015 financial markets. S&P 500 will see an increase of about 12%. Core inflation will remain low at 2%. The Federal Reserve will keep interest rates low, either 0% or .75% later in 2015. With short term interest rates low (yield curve), we expect economic activity to be adequate with GDP finishing at 3.3% for the year. Expect corporate earnings to grow by 9%. The markets will correlate with the direction of earnings.  Equities will continue to run at high multiples, bringing increased volatility. Four to six percent corrections will allow the market to push higher after pullbacks. Corral your fears, look for buying opportunities. With slower global economic growth, weaker bond market, investors will continue to pay a premium and pour money into US equities. We could be in a period where the market returns double digit gains for a number of years. Top line revenue may be slow, but companies will do a great job of managing costs/profit margins, stock buybacks will continue contributing to overall increased valuations. Low interest rates, slow growth abroad, should bode well for capital funds to continue to flow into US equities. Cost of capital will remain low giving rise to more M&A activity.  Economic activity will continue to be driven by the slope of the yield curve. The yield curve will be far from flattening (sign that the bull has run and a recession is looming) out. Consumers will continue to benefit from lower oil prices, at least into the second half of the year. Barring any type of extreme geopolitical event, oil should provide a better stimulus than any fiscal policy our government could agree on. Consumer spending will accelerate. Expect housing to show signs of ongoing improvement. The Fed interest rate will remain at close to zero, and finish the year at .75%. Inflation will remain at 2%, or less, for the foreseeable future. Low oil prices, strong dollar, and low wage growth will all contribute to keeping inflation at bay.

Bradford C. Bruner for Sua Sponte Wealth Management

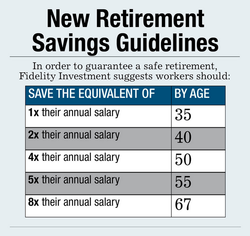

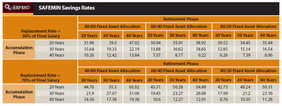

AT SSWM we are in it for the long haul. While we do monitor market and economic activity daily, we like to think we have our sights set 5 to 10 years out. So, it never fails that it comes down to the last two weeks of the year. Will the market run, or continue to be brought down by the anchor that has become oil? Dreams of a Santa Claus rally dance in our head. Anyway, retirement seems to be on everyone's mind these days. Whether it is a recent IPO that has put more wealth in your pocket or your inner-strength for sticking with this cyclical bull market, you have no doubt thought about how much it would take for you to take the watch and walk. Fidelity has an easy grid that would have one calculate the money required at retirement by a simple multiple. For example, above, you should have at least 5 times your ending salary by age 55. This will help you replace 85% of your pre-retirement income. We've heard recently that you'll need a minimum flat rate of over one million dollars to retire. This seems to be a little better than just a guess and takes into account a few data variables. Of course, this is a quick rule of thumb, and with any investment decisions you should consult you financial professional as your particular situation may vary. Many assumptions have gone into the Fidelity Grid, including: a retirement age of 67, living until age 92, 3% employer contribution, and a 5.5% average annual portfolio growth rate. Every 401(k) website has a calculator and every financial institution has their won theory or method. We like this one because it is simple and does not contain the 'slick' sales pitch of the other sites' tools.  Professor Wade Pfau, looked at market returns between 1871 and 2009. Using that data, he analyzed the numbers and came up with the "safe savings rate" that would guarantee retirement income in any a bull or bear market. His grid can be viewed at the right. An example, using his table, would be if you have 30 years to save and want to replace 50% of your income, use the 60/40 asset allocation (60% stocks and 40% bonds) and save 16.2% of your salary every year. The earlier the better. If you have 40 years until retirement, the savings rate drops to 8.77%.  Demographic and economic changes will continue to be in play, disrupting all methodologies. We have seen it happen already with declining birth rates, resulting in fewer new workers funding the costs of Social Security. By 2033, the Social Security program will not have enough funds to cover the promised benefits. This shortfall will only be rectified by cutting benefits or raising taxes. Don't count on Social Security to be there. Some things you can plan on are working longer and continuing to update your skills. By delaying retirement to 70 from 62, you can increase Social Security checks by 76%. Many will be fortunate enough to win the lottery, have a rich uncle that leaves you everything, be first in line when the IPO clears, or put it all on Eight in Vegas and win. All of these are not much of a strategy. Setting up clear goals that are linked to your salary can provide a formula for serious planning. There are so many variables that could derail your best laid plans. Layoffs, accounting fraud, job switching, longer life expectancy, student loan debt, and escalating health care costs can complicate your efforts to save for retirement. Live for today, spend it all and more; or work on your own calculation and work longer and harder? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

Highlights from the Conference, but you'll want to flip through the Charts

Bradford C. Bruner for Sua Sponte Wealth Management

|

Sponsors - Contributors

|

||||||||||||||||||||||||

|

|