AT SSWM we are in it for the long haul. While we do monitor market and economic activity daily, we like to think we have our sights set 5 to 10 years out. So, it never fails that it comes down to the last two weeks of the year. Will the market run, or continue to be brought down by the anchor that has become oil? Dreams of a Santa Claus rally dance in our head. Anyway, retirement seems to be on everyone's mind these days.

Whether it is a recent IPO that has put more wealth in your pocket or your inner-strength for sticking with this cyclical bull market, you have no doubt thought about how much it would take for you to take the watch and walk.

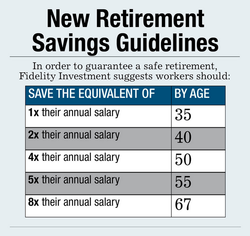

Fidelity has an easy grid that would have one calculate the money required at retirement by a simple multiple. For example, above, you should have at least 5 times your ending salary by age 55. This will help you replace 85% of your pre-retirement income. We've heard recently that you'll need a minimum flat rate of over one million dollars to retire. This seems to be a little better than just a guess and takes into account a few data variables.

Whether it is a recent IPO that has put more wealth in your pocket or your inner-strength for sticking with this cyclical bull market, you have no doubt thought about how much it would take for you to take the watch and walk.

Fidelity has an easy grid that would have one calculate the money required at retirement by a simple multiple. For example, above, you should have at least 5 times your ending salary by age 55. This will help you replace 85% of your pre-retirement income. We've heard recently that you'll need a minimum flat rate of over one million dollars to retire. This seems to be a little better than just a guess and takes into account a few data variables.

Of course, this is a quick rule of thumb, and with any investment decisions you should consult you financial professional as your particular situation may vary. Many assumptions have gone into the Fidelity Grid, including: a retirement age of 67, living until age 92, 3% employer contribution, and a 5.5% average annual portfolio growth rate. Every 401(k) website has a calculator and every financial institution has their won theory or method. We like this one because it is simple and does not contain the 'slick' sales pitch of the other sites' tools.

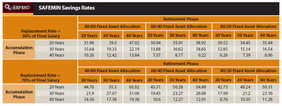

Professor Wade Pfau, looked at market returns between 1871 and 2009. Using that data, he analyzed the numbers and came up with the "safe savings rate" that would guarantee retirement income in any a bull or bear market. His grid can be viewed at the right.

An example, using his table, would be if you have 30 years to save and want to replace 50% of your income, use the 60/40 asset allocation (60% stocks and 40% bonds) and save 16.2% of your salary every year. The earlier the better. If you have 40 years until retirement, the savings rate drops to 8.77%.

An example, using his table, would be if you have 30 years to save and want to replace 50% of your income, use the 60/40 asset allocation (60% stocks and 40% bonds) and save 16.2% of your salary every year. The earlier the better. If you have 40 years until retirement, the savings rate drops to 8.77%.

Demographic and economic changes will continue to be in play, disrupting all methodologies. We have seen it happen already with declining birth rates, resulting in fewer new workers funding the costs of Social Security. By 2033, the Social Security program will not have enough funds to cover the promised benefits. This shortfall will only be rectified by cutting benefits or raising taxes.

Don't count on Social Security to be there. Some things you can plan on are working longer and continuing to update your skills. By delaying retirement to 70 from 62, you can increase Social Security checks by 76%.

Many will be fortunate enough to win the lottery, have a rich uncle that leaves you everything, be first in line when the IPO clears, or put it all on Eight in Vegas and win. All of these are not much of a strategy. Setting up clear goals that are linked to your salary can provide a formula for serious planning. There are so many variables that could derail your best laid plans. Layoffs, accounting fraud, job switching, longer life expectancy, student loan debt, and escalating health care costs can complicate your efforts to save for retirement. Live for today, spend it all and more; or work on your own calculation and work longer and harder? Sua Sponte.

Don't count on Social Security to be there. Some things you can plan on are working longer and continuing to update your skills. By delaying retirement to 70 from 62, you can increase Social Security checks by 76%.

Many will be fortunate enough to win the lottery, have a rich uncle that leaves you everything, be first in line when the IPO clears, or put it all on Eight in Vegas and win. All of these are not much of a strategy. Setting up clear goals that are linked to your salary can provide a formula for serious planning. There are so many variables that could derail your best laid plans. Layoffs, accounting fraud, job switching, longer life expectancy, student loan debt, and escalating health care costs can complicate your efforts to save for retirement. Live for today, spend it all and more; or work on your own calculation and work longer and harder? Sua Sponte.

| charles_schwab_-_retirement_spending__how_much_can_you_afford_.pdf |

Bradford C. Bruner for Sua Sponte Wealth Management