(click to enlarge)

The Shiller PE ratio for the S&P 500 is based on average inflation-adjusted earnings from the previous 10 years. It is also know as the the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio or the P/E10.

The CAPE utilizes earnings from the prior 10 years. The numerator is the real value of the S&P 500. Real meaning adjusted for inflation. The denominator is the moving average of the preceding 10 years of the S&P 500 real reported earnings.

The CAPE utilizes earnings from the prior 10 years. The numerator is the real value of the S&P 500. Real meaning adjusted for inflation. The denominator is the moving average of the preceding 10 years of the S&P 500 real reported earnings.

(click to enlarge)

The purpose of the CAPE looking at the previous 10 years real reporting earnings is to control business-cycle effects. The caution here would be that business cycles typically last 6 years. Recent trends indicate that recessions are shorter and expansions are longer. The risk would be that the CAPE tends to overestimate true average earnings during contractions and underestimate average earnings during recessions.

(click to enlarge)

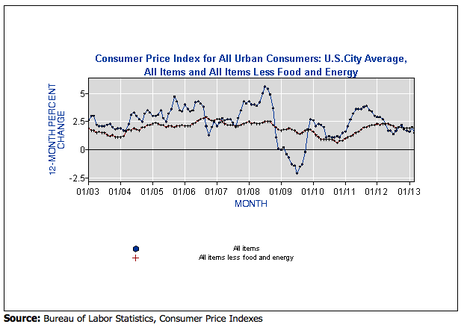

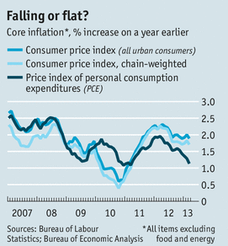

As we discussed last week, the Bureau of Labor Statistics often changes the manner in which the CPI is determined. This will have an impact on the reported inflation number. Changes also occur to the corporate taxation policies and accounting standards. Non-recurring, one time charges, earnings impacted items are reflected for a full 10 year period. Other measures treat these 'one timers' in the current period and leave them behind when measuring current periods. Another factor to take into account is that the stock market can remain over valued for a long time before any type of correction takes place.

(click to enlarge)

What do you use to measure the market? Do you still believe that this rally is Fed driven only? Do you reference the CAPE, P/E only, forward and TTM P/Es? Five-year normalized P/E? Throw darts? Recommendation is to consult them all, do your homework, do your best. Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management.

Bradford C. Bruner for Sua Sponte Wealth Management.