(click to enlarge)

If you go over a cliff, without a seatbelt, you'll hit the ceiling. That's the way gravity works. Our government leaders appear to have this same Newtonian relationship. Hang on, here we go, over the cliff and 'smack' up against the ceiling.

The ceiling we are talking about is the debt ceiling. We set the debt limit at $16.4 trillion back in 2011. Guess where we are today, yes, $16.4 trillion. This is the amount we owe to meet our expense obligations. It is projected that the U.S will run out of cash, completely, in February or March. You'll remember that the debt is the total amount we owe. The deficit is how much in the red we are in a given year. Our current budget deficit is $1.1 trillion.

The ceiling we are talking about is the debt ceiling. We set the debt limit at $16.4 trillion back in 2011. Guess where we are today, yes, $16.4 trillion. This is the amount we owe to meet our expense obligations. It is projected that the U.S will run out of cash, completely, in February or March. You'll remember that the debt is the total amount we owe. The deficit is how much in the red we are in a given year. Our current budget deficit is $1.1 trillion.

(click to enlarge)

Indications would be that consumers are feeling pretty good. Consumer confidence is up. Those that have been able to hold on to their homes are seeing values increase and an overall recovery in the housing market appears to have legs. The stock market has had a good year, all things considered. If you have a job, you are still looking over your shoulder for a possible shoe to drop, but feeling a little more optimistic that things are getting better. Not real sure how many consumers really understand the implications of the fiscal cliff, or for that matter, how many care. The one basic understanding we should have is that any drastic action by congress could drive us into another recession.

(click to enlarge)

We need confident consumers, consumption is 70% of GDP. Business confidence is the better economic barometer. It remains down. Stuck, waiting for any type of resolution. It is estimated that companies have over $2 trillion in cash sitting in wait. Don't look for that confidence to improve any time soon, but any turmoil in the market should be viewed as a buying opportunity. And how will we know?

(click to enlarge)

Watch for markets to trend lower. Watch for tomorrow (12.31), and the weeks to follow, to be volatile. A market plunge will force the hand of congress. Look for a buying opportunity on the dips. The same thing happened with the debt downgrade in 2011. In July, of 2011, the S&P 500 was trading at 1,340. Our debt was downgraded to AA from a AAA rating. In the six weeks following, the S&P fell by 16% to 1,124. The market closed on 12.18.2012 at 1,447, up a whopping 28.8%.

(click to enlarge)

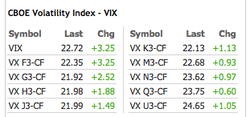

If you are not familiar with the VIX, it pays to get to know it. Bookmark it on your financial tracker. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. Since its introduction in 1993, VIX has been considered by many to be the world's premier barometer of investor sentiment and market volatility. It's a nice tool and may help us through the next few weeks. Volatility has increased from 15.87 on 11.30.2012 to today's close of 21.79, an increase of 37.3%. Things are heating up. 15.57 on 12.18.2012, that is a 39.95% increase in less than two weeks.

(click to enlarge)

The VIX futures, by month, are a useful tool also. This is the gauge of future volatility. Watch the VIX for the pulse of shakiness in the market, use the VIX futures to get a view of future uneasiness. "F" in the table to the right is for January and so on.

(click to enlarge)

The chart to the left would be an early indication that the S&P will open lower tomorrow (12.31) and head lower. 1,400 is a pretty important psychological benchmark. If we open lower, we are headed down. That 'swoosh' you hear will be the economy going over the cliff, listen for the 'clunk', that will be our heads hitting the ceiling. The S&P is fairly valued at a PE of 15.69. This is Sunday night and talks continue in Washington. Any move lower could be a buying opportunity. Think you have the stomach to profit from the volatility, uncertainty, and governmental anxiety? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

Bradford C. Bruner for Sua Sponte Wealth Management