At my age, and especially this time of year, Dads can receive a lot of bad news. What is the worst thing that a Dad can hear? “Honey, I’m pregnant,” from your wife? “Looks like you need a new furnace,” from the HVAC guy on Thanksgiving weekend? “I need to refer you to a specialist,” from your doctor when a nagging cough will not go away? Nope, worse than all of those? “I think I’m going to change my major,” one of your children announces at the holiday table.

Trying to get the best return on my investment, I drop my fork and start to do the numbers in my head. Extending the expenses another year and a half. The calculation tends to get a little complex and it’s necessary to adjust for the other two siblings who are 3 years apart. I grab a piece of pie, I’ll work the spreadsheet later. These costs are out of control. It used to be a house that was the single biggest investment a person could make. Is college education still considered an investment?

Trying to get the best return on my investment, I drop my fork and start to do the numbers in my head. Extending the expenses another year and a half. The calculation tends to get a little complex and it’s necessary to adjust for the other two siblings who are 3 years apart. I grab a piece of pie, I’ll work the spreadsheet later. These costs are out of control. It used to be a house that was the single biggest investment a person could make. Is college education still considered an investment?

(click to enlarge)

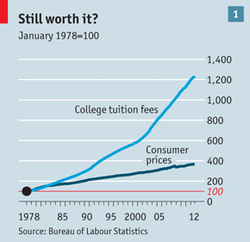

Both the student debt, and that of institutions, is increasing. Tuition has increased at 5 times the rate of inflation since 1983 (chart 1). As tuition becomes less affordable, there is a propensity to take on more debt. Costs are taking a larger bite out of our income. Costs increased from 23% to 38% of median income between 2001 and 2010. It only took 15 years for the debt per student to double in size. The average debt of a 2011 graduate was $26,000. When you look at investments, usually with increased risk comes increased chance of greater returns. With the current education model, risk is going up, return is going down. Chances of a 4 year degree being completed in 6 years is 57%. I don't like those odds.

(click to enlarge)

Universities have debts too. Balance sheets are declining as they spend beyond their means. Similar to mortgage backed securities during the housing bubble, complex instruments have also been used to take advantage of this debt gravy train. That train is running out of track. Securitization of student loan debt declined from $20 billion in 2008 to just $6 billion in 2011. Mostly sidelined by regulation and the fear of another collapse.

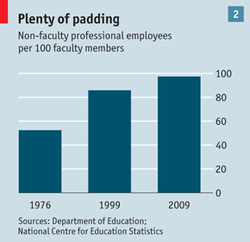

If the toll way near your house increases rates, but you see new paving, increased safety measures, and efforts to keep costs contained, it’s a little easier to take a rate increase. Not the same with education, no continuous improvements seen here. There have been very few course/curriculum improvements. Most of the money is spent ensuring good rankings on college survey tables. It is impossible to rank the quality of the output (students). Expenditure on curriculum and instruction is the slowest growing segment, despite the growth in student numbers (chart 2).

If the toll way near your house increases rates, but you see new paving, increased safety measures, and efforts to keep costs contained, it’s a little easier to take a rate increase. Not the same with education, no continuous improvements seen here. There have been very few course/curriculum improvements. Most of the money is spent ensuring good rankings on college survey tables. It is impossible to rank the quality of the output (students). Expenditure on curriculum and instruction is the slowest growing segment, despite the growth in student numbers (chart 2).

While the government talks about the situation, don’t count on them to do anything soon. State budgets are tight and we may see continued reductions in state funding, shifting an increased burden to students. Look for enrollments to remain flat for at least the next 5 to 7 years, even as we recover from the depression like economic malaise.

There just isn’t any value creation justification for the increase in tuition costs. The quality of students and graduates is declining. The literacy of college students has declined. Only ¼, of enrolled, are deemed proficient. 1/3 of students do not take courses that require more than 40 pages of written material over the course of a term. Students are looking for easy classes, easy teachers and spending more time on recreation rather than on studies. 43% of all grades at 4 year universities were As. This represents an increase of 28% since 1960. The average GPA in the ‘50s was 2.52 versus 3.11 in 2006. Something smells fishy.

There just isn’t any value creation justification for the increase in tuition costs. The quality of students and graduates is declining. The literacy of college students has declined. Only ¼, of enrolled, are deemed proficient. 1/3 of students do not take courses that require more than 40 pages of written material over the course of a term. Students are looking for easy classes, easy teachers and spending more time on recreation rather than on studies. 43% of all grades at 4 year universities were As. This represents an increase of 28% since 1960. The average GPA in the ‘50s was 2.52 versus 3.11 in 2006. Something smells fishy.

| Statistic Snapshot:

| Snapshot – Purdue University:

|

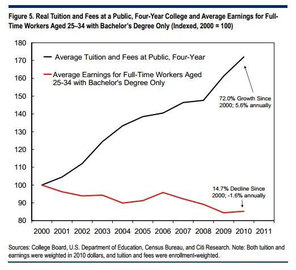

(click to enlarge)

I blame the institutions for their inability to innovate. This is broken. Tear up the 200 year old playbook. We must find a way to extract the educational premium. To maximize our ROI. Embrace technology to reduce the costs. Unbundling the costs of higher education may be the answer. We are already seeing the impact of the Internet on education. Perhaps the cloud offers the answer. Have a buffet of accredited offerings at a standard rate. Economics credits from Harvard, Finance from Brown, Philosophy from Rutgers; all resulting in a standardized test required to pass the course. Taken when you want it, where you can. Not subject to sabbatical schedules and extended professorial vacations. Reduce the overhead, reduce the time and reduce the cost. Miss the social aspect of campus? We have Facebook. How was your Thanksgiving, your furnace working properly? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

Bradford C. Bruner for Sua Sponte Wealth Management