(click to enlarge)

If you have been unemployed, underemployed, or employed with no raise during this recession, you may have been paying particularly close attention to the inflation numbers.

Inflation is the rise in the level of prices of goods and services over a period of time. When the price level increases, our dollar buys fewer goods and services. Inflation reflects a reduction in the purchasing power of the dollar.

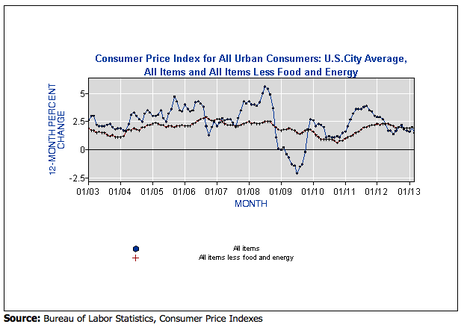

The Consumer Price Index (CPI) is the standard measure of inflation. The CPI measures a basket of goods and services from 12,200 selected households. The change in cost is the inflation rate. The case can be made that this measure overstates the inflation rate because it does not take into account that consumers continually adjust buying patterns to purchase the most inexpensive items.

Inflation is the rise in the level of prices of goods and services over a period of time. When the price level increases, our dollar buys fewer goods and services. Inflation reflects a reduction in the purchasing power of the dollar.

The Consumer Price Index (CPI) is the standard measure of inflation. The CPI measures a basket of goods and services from 12,200 selected households. The change in cost is the inflation rate. The case can be made that this measure overstates the inflation rate because it does not take into account that consumers continually adjust buying patterns to purchase the most inexpensive items.

(click to enlarge)

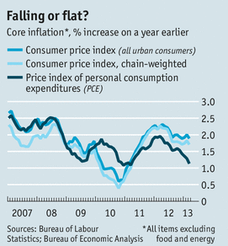

Not new, but not often apparent to the consumer is the chain-weighted version of the CPI. The PCI, Personal Consumption Expenditure, continuously updates data to reflect changes in spending patterns. The Bureau of Economic Analysis first starting using this data in 2002. Under this index, inflation runs at 1/3 point lower and under the chain-weighted CPI, 1/4 lower than the traditional CPI.

The Federal Reserve Board uses the PCE for its economic forecast and decisions surrounding inflation. As long as the PCE and CPI are reacting the same, all should be good. Up until recently they have been. Currently, PCE shows inflation at 1.1% while the CPI has inflation running at 1.9%.

With close to 1 percentage point between the two, it is easy for both monetary and fiscal policy to fall victim to data interpretation. Look for both Democrats and Republicans to use one or both to their advantage. Whatever suites their agenda.

Don't you just want to know how much your hard earned dollar can buy versus last quarter, or compared to last year? Just what number are we to use? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

The Federal Reserve Board uses the PCE for its economic forecast and decisions surrounding inflation. As long as the PCE and CPI are reacting the same, all should be good. Up until recently they have been. Currently, PCE shows inflation at 1.1% while the CPI has inflation running at 1.9%.

With close to 1 percentage point between the two, it is easy for both monetary and fiscal policy to fall victim to data interpretation. Look for both Democrats and Republicans to use one or both to their advantage. Whatever suites their agenda.

Don't you just want to know how much your hard earned dollar can buy versus last quarter, or compared to last year? Just what number are we to use? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management