Did you know that the entire Friends series is now available on Netflix? Yes, it became available after midnight on New Year's Day. I'm glad to see that it has been well received in our family, at 22 minutes per episode (no commercials of course), it is an excellent value in the humor sector.

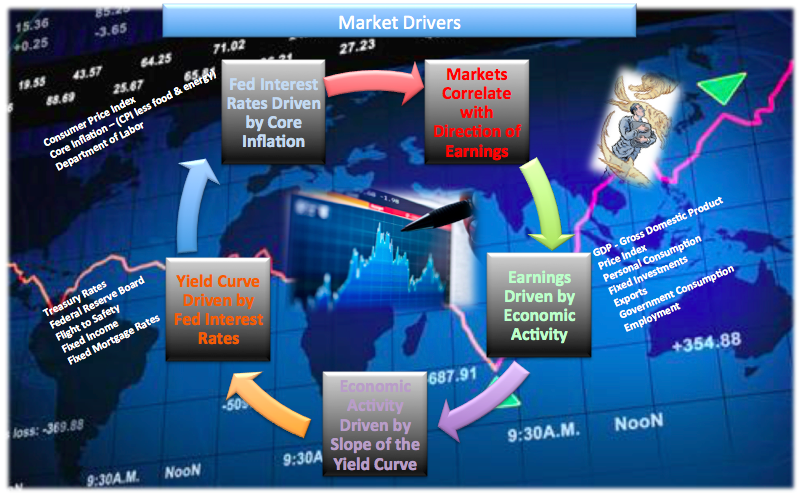

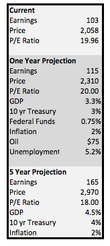

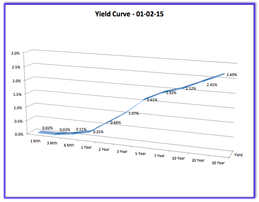

About the only other rerun worth watching this year will be the year itself. We see a replay of 2014 in the 2015 financial markets. S&P 500 will see an increase of about 12%. Core inflation will remain low at 2%. The Federal Reserve will keep interest rates low, either 0% or .75% later in 2015. With short term interest rates low (yield curve), we expect economic activity to be adequate with GDP finishing at 3.3% for the year. Expect corporate earnings to grow by 9%. The markets will correlate with the direction of earnings.

About the only other rerun worth watching this year will be the year itself. We see a replay of 2014 in the 2015 financial markets. S&P 500 will see an increase of about 12%. Core inflation will remain low at 2%. The Federal Reserve will keep interest rates low, either 0% or .75% later in 2015. With short term interest rates low (yield curve), we expect economic activity to be adequate with GDP finishing at 3.3% for the year. Expect corporate earnings to grow by 9%. The markets will correlate with the direction of earnings.

Equities will continue to run at high multiples, bringing increased volatility. Four to six percent corrections will allow the market to push higher after pullbacks. Corral your fears, look for buying opportunities. With slower global economic growth, weaker bond market, investors will continue to pay a premium and pour money into US equities. We could be in a period where the market returns double digit gains for a number of years. Top line revenue may be slow, but companies will do a great job of managing costs/profit margins, stock buybacks will continue contributing to overall increased valuations. Low interest rates, slow growth abroad, should bode well for capital funds to continue to flow into US equities. Cost of capital will remain low giving rise to more M&A activity.

Economic activity will continue to be driven by the slope of the yield curve. The yield curve will be far from flattening (sign that the bull has run and a recession is looming) out. Consumers will continue to benefit from lower oil prices, at least into the second half of the year. Barring any type of extreme geopolitical event, oil should provide a better stimulus than any fiscal policy our government could agree on. Consumer spending will accelerate. Expect housing to show signs of ongoing improvement. The Fed interest rate will remain at close to zero, and finish the year at .75%. Inflation will remain at 2%, or less, for the foreseeable future. Low oil prices, strong dollar, and low wage growth will all contribute to keeping inflation at bay.

| The economy continues to present challenges for the common man. Wages are stagnant, the employment participation rate is extremely low at 62.8 and if you have found a job in this post recession economy, chances are that you are underemployed. It has been an employer's market since 2008. There remains slack in the economy, we will be watching for signs that the employment landscape is shifting from weak demand to a tighter supply. If you can get in the market, get in. If you are in the market, stay in the market. This bull run is not going to end just because valuations are high. We do need to watch deflationary pressure brought on by the the almost 50% decline in oil. We do not see this lasting, but we do see a comfortable landing in the price per barrel that benefits both consumers and producers. China and Europe will continue to struggle. Fed monetary tightening will be pushed out to the end of the third quarter. We will see pent up demand for capital investment. Both companies and households will have to invest. This will boost the markets and the economy. "The One Where We Have a Repeat of Last Year?" What's your guess on 2015? Sua Sponte. |

Bradford C. Bruner for Sua Sponte Wealth Management