So what is the worst thing that can happen before the bell? Congress announces that Obama is a psychopath and they will refuse to work with him in the coming session? Bernie Ebbers has been released from jail and he is getting his team back together in an effort to consolidate wireless carriers? The world missed it, it wasn't Ebola that was a threat to the globe, it's the newly mutated Ebola II? That your student loan interest rate has been increased by 2% on money that the student loan administration receives for free and then lends to you at a criminal rate? No, it's that one of your equity holdings has been targeted by the short selling machine of media manipulators and inside traders.

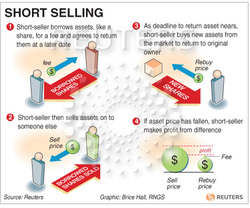

What is short selling? It is a bet that equity shares that a trader has borrowed (yes, they do not even pay for them) will decrease in value. Really not much of a bet but a calculated scheme. Borrow a bunch of shares <> sell those shares to someone else <> inform your insiders to sell at the close (high) <> leak to the markets of your impending report release <> release fabricated negative data <> stock tanks <> short seller buys shares at the bottom <> short seller returns borrowed shares <> profit is the margin between the high and the low market manipulated share price. Short sellers, and those trading on the inside information, can also buy on the 'panic dip' and sell when the stock returns to fair value.

You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

Such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein.

- Ametek's aggressive roll-up story appears too-good to be true; its ability to beat Wall Street's quarterly earnings estimates 95% of the time in over a decade raises alarms.

- We believe its EBITDA margins appears 400 - 600 bps overstated, and have collected 17 financial documents across 10 countries to support our claim.

- A 2009 whistleblower case claimed improper revenue and inventory accounting. The controller who worked with him was indicted by the FBI. Ametek's Indian auditor raised similar revenue/inventory accounting concerns.

- Ametek trades at an irrational premium to the sum of its acquired businesses, many of which have no growth and declining margins.

- If Ametek were to trade in line with peers at 2x sales and 10x our Adj. EBITDA estimate, there would be up to 50% downside.

What a living nightmare. Fear runs like wildfire as you have flashbacks of Bernie Ebbers, Joe Nachio, Jack Grubman, and Arthur Anderson. Was it a possible repeat scenario where the CEO is colluding with the analyst who are both backed by a corrupt accounting firm? Could the company that you saw value in be a total scam? Could you lose all of the value that you work so hard to secure? Sure, we always say that there is a thin line between perception and reality. Greed is powerful, fear is paralyzing.

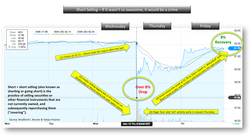

Well, it worked. Fear gripped the shares, they tanked. Shorts and insiders profit by more than 8%, not including client fees and other insider profits and charges. Shares recovered and we move into a new week with a new company for Spruce Point to target.

Bradford C. Bruner for Sua Sponte Wealth Management