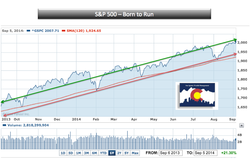

There are two types of investors in the Great Recession, those that are in the market and those that are not. Bad enough that wages are stagnant, or falling; personal savings are near zero, college debt is growing exponentially, anxiety over job search or job retention is a daily concern, but if you are not in the market, you have missed one of the greatest bull run's in market history. Is it too late? We think not.

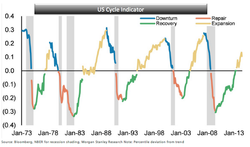

SSWM is still bullish, and we think that the next five years could provide additional positive returns. The longest expansion in US history (see attachment below) ran from March 1991 to March 2001. We see a long, gradual, grueling recovery continuing for a few years to come.

SSWM is still bullish, and we think that the next five years could provide additional positive returns. The longest expansion in US history (see attachment below) ran from March 1991 to March 2001. We see a long, gradual, grueling recovery continuing for a few years to come.

SSWM likes the Morgan Stanley indicator to the right. It measures the deviation from historical norms for macro factors including employment, credit conditions, corporate behavior, and the yield curve. It then divides the economic cycle into four different parts: downturn, repair, recovery, and expansion. By this measure, the US has only recently entered the expansion phase of the economy and still has a good way to go. How much of the expansion is already priced into the market is the variable.

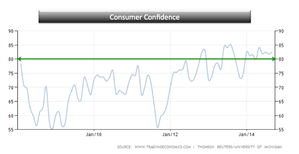

Recovery phase is driven by Consumer Confidence. 80, passed back in March, is the start of the recovery. Expansion would start at the 100 level, a ways to go. Levels of corporate debt should not create any problems in the next few years. Historic low interest rates allowed corporations to push debt maturity out and interest coverage from 4x to 8x since the end of the crisis.

What could upset the run and send the market down 10% plus? Just about anything. Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

What could upset the run and send the market down 10% plus? Just about anything. Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

| SSWM US Business Cycles |