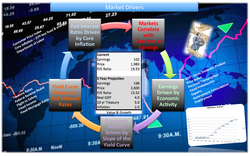

The next 9 months will be a wild ride in the markets. Ups, downs, sideways, corrections and continued bull runs. The inevitable Federal Reserve interest rate hike, we estimate at the end of Q2 2015, will have traders and investors worried, but this market will continue to claw forward and close the year at around 2,050 on the S&P 500.

We are about 5 years into the recovery, the Federal Reserve's economic stimulus has paved the way for a great run in the markets. Businesses and consumers have been able to take advantage of ultra-low interest rates to refinance debt and freeing up cash to spend. Interest rates have been close to zero for some time.

We are about 5 years into the recovery, the Federal Reserve's economic stimulus has paved the way for a great run in the markets. Businesses and consumers have been able to take advantage of ultra-low interest rates to refinance debt and freeing up cash to spend. Interest rates have been close to zero for some time.

Federal Funds Rate

Federal Funds Rate Rising interest rates are a sign of a healthier economy, that should mean that businesses are continuing to do well and that should be good for stocks. A healthier economy should be good for corporate earnings. History would show that, after an initial stage of turbulence, stocks rise with rising interest rates (see Charts tab).

Usually the trouble begins after the Fed has raised rates several times. There is a very delicate balance between economic growth and interest rates. Higher rates eventually put the brakes on the economy and turn the market bearish. The last cycle of rate hikes topped out at 5.25 percent, with the final increase coming in June 2006. Stocks peaked in October of the following year.

Usually the trouble begins after the Fed has raised rates several times. There is a very delicate balance between economic growth and interest rates. Higher rates eventually put the brakes on the economy and turn the market bearish. The last cycle of rate hikes topped out at 5.25 percent, with the final increase coming in June 2006. Stocks peaked in October of the following year.

S&P 500 and 5 Year Treasury Yield

S&P 500 and 5 Year Treasury Yield We think that the Fed will raise rates gradually, and while this recovery remains extremely painful for many, the economy will continue to expand and stocks will continue on their up trend. The next bear market will occur when rates peak, growth slows, and the next recession begins - so goes the cycle.

What could derail this bull run? A catastrophic unknown event, a miss on corporate earnings, or a miss by the Fed on gauging the rate of inflation. "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves" (BusinessWeek, September 2014). Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

What could derail this bull run? A catastrophic unknown event, a miss on corporate earnings, or a miss by the Fed on gauging the rate of inflation. "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves" (BusinessWeek, September 2014). Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management