(click to enlarge)

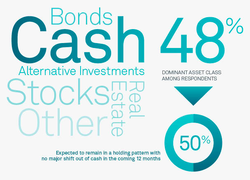

(click to enlarge) US investors have missed the post economic meltdown bull market. 50% of investors are holding their investments in no, or low, return cash type investments. It is a delicate situation. Many, too late to get on the train, remain in the station in an effort to avoid a potential catastrophic correction similar to 2008. The majority of investors say the will remain in cash for the next 12 months. We anticipate this bull market has at least 3 more years, if not 5, to run. If inflation increases and/or interest rates rise, you could be going backwards. Why are investors so skeptical?

(click to enlarge)

(click to enlarge) Consumers are scared. Incomes are flat or down. Those that do have jobs, are not feeling secure. Raises are nonexistent. Those that are unemployed are losing faith that sustainable employment is available. The graphic to the right would suggest that 16% of take home pay is invested. The SSWM, informal survey , indicates that savings is not an option for most individuals. Income is equal to expenses and 401(K) salary deductions have been taken to 0% participation, even when there is an employee match. Folks need all the income they can muster, and any extra is not going into equity investments. Appears we are keeping what we have and putting it into the mattress.

(click to enlarge)

(click to enlarge) With no confidence in the economy, our legislators, the financial markets, and employers, investors are not feeling good about their futures. 50% of investors are not confident that they are making the right investing decisions. These are challenging times. Individuals we talk to appear as if they are adrift at sea with no course of action and no way to get back to port. When there is so much day to day anxiety in life it is difficult to calm down, take a step back and re-engage your investment professional. Better to do something, than to do nothing.

(click to enlarge)

(click to enlarge) The demographic range of Americans in the 55-to-64 age range have accumulated retirement assets of only $120,000. That small amount will produce about $400 to $500 of income per month.

It's not too late for those over 50. The key, limit consumption. If you can't find extra cash to save or invest, reduce the amount of expenses and invest the balance.

Some other ideas:

Don't plan for retirement, plan to keep working.

Consider staying in equities longer

Carefully time the equity in your house

It's not too late for those over 50. The key, limit consumption. If you can't find extra cash to save or invest, reduce the amount of expenses and invest the balance.

Some other ideas:

Don't plan for retirement, plan to keep working.

- add to your savings, less time to depend on savings.

- burnt out - plan now for a middle of the road second career. One more rewarding and enjoyable.

- delay your retirement and social security will be worth more.

Consider staying in equities longer

- If you push out your retirement calendar, consider staying in equities longer.

- Interest rates appear to be low for the foreseeable future, could be risky long term.

- In the post–World War II era, when interest rates rose after a long period of artificially low rates, bondholders lost money.

- Forecast to live to about 85, hold of going into bonds until you are about 70, enter gradually.

Carefully time the equity in your house

- Sell your house and downsize, you'll be able to use the proceeds to add to your retirement savings, tax rules permitting.

- Enables reduction of monthly expenses.

- Emotion aside, the sooner you can practically make the move, the better off you will be.

How are you feeling? Share your strategy. Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

Bradford C. Bruner for Sua Sponte Wealth Management