This week, Colorado's CollegeInvest announced it was closing its Colorado Prepaid Tuition fund on November 1st. A recent actuarial report showed negative cash flows, currently, and when trended out for the remaining life of the fund. A knife was stuck through the proverbial heart of the fund with a cry of. "I'm unsound and no longer financially viable". A fitting metaphor for the entire state of our college financing dilemma. You really can't save, grow, and pay. Some of Colorado's sharpest minds couldn't even get the formula to calculate.

Prepaid tuition funds allow investors to pay for future college tuition costs at present-day rates. State-based plans typically guarantee a rate of return that varies with changes in tuition. As the tuition rate increases year to year, so does the rate of return.

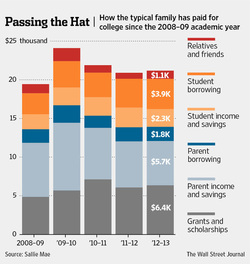

(click to enlarge)

The Prepaid Tuition Fund (Fund) was established in 1997 to provide families with an opportunity to save for future college education expenses. The Fund offered an annual enrollment period for purchasers to buy prepaid tuition contracts.

The Fund offers certain federal and State tax advantages to investors. The Fund was designed to keep pace with average tuition inflation in Colorado. Under the original contract terms, a purchaser bought tuition units based on current average tuition levels and the investment was valued and paid out at the level of average tuition or an average minimum of 4% per year over the life of the contract (when held until the first payout date), whichever was greater, at the time of payout.

The contract terms were amended on February 20, 2003. Under the new terms, the annual increase in average tuition as defined below is limited to the lesser of 1) the percentage increase in actual average tuition at Colorado public colleges and universities or 2) 5.5%. Average tuition is determined annually by the Fund by adding (1) the sum of the applicable year’s resident, undergraduate, general full-time tuition at all Colorado public four-year colleges and universities, to (2) the average full-time tuition at the State community colleges for that year. Full-time tuition equates to the tuition charged for the equivalent of fifteen credit hours for each of two semesters. The total of (1) and (2) above is then divided by the number of Colorado public four-year colleges and universities in existence at such time plus one for the State community colleges.

A purchaser can use amounts contributed and earned in the Fund to pay eligible expenses at private and public colleges, universities and vocational schools throughout the United States.

The Fund offers certain federal and State tax advantages to investors. The Fund was designed to keep pace with average tuition inflation in Colorado. Under the original contract terms, a purchaser bought tuition units based on current average tuition levels and the investment was valued and paid out at the level of average tuition or an average minimum of 4% per year over the life of the contract (when held until the first payout date), whichever was greater, at the time of payout.

The contract terms were amended on February 20, 2003. Under the new terms, the annual increase in average tuition as defined below is limited to the lesser of 1) the percentage increase in actual average tuition at Colorado public colleges and universities or 2) 5.5%. Average tuition is determined annually by the Fund by adding (1) the sum of the applicable year’s resident, undergraduate, general full-time tuition at all Colorado public four-year colleges and universities, to (2) the average full-time tuition at the State community colleges for that year. Full-time tuition equates to the tuition charged for the equivalent of fifteen credit hours for each of two semesters. The total of (1) and (2) above is then divided by the number of Colorado public four-year colleges and universities in existence at such time plus one for the State community colleges.

A purchaser can use amounts contributed and earned in the Fund to pay eligible expenses at private and public colleges, universities and vocational schools throughout the United States.

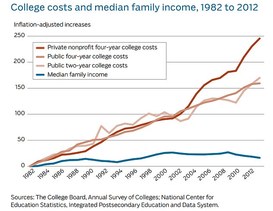

(click to enlarge)

In the case of the Colorado state fund, it became unsustainable because of rapidly increasing tuition rates during the past decade. Instead of the expected 3 or 4 percent rate of return, the fund was paying its maximum 5.5 percent rate, and that could not keep pace with skyrocketing tuition increases.

A good rule of thumb is that tuition rates will increase at about twice the general inflation rate. During any 17-year period from 1958 to 2001, the average annual tuition inflation rate was between 6% and 9%, ranging from 1.2 times general inflation to 2.1 times general inflation. On average, tuition tends to increase about 8% per year. An 8% college inflation rate means that the cost of college doubles every nine years.

A good rule of thumb is that tuition rates will increase at about twice the general inflation rate. During any 17-year period from 1958 to 2001, the average annual tuition inflation rate was between 6% and 9%, ranging from 1.2 times general inflation to 2.1 times general inflation. On average, tuition tends to increase about 8% per year. An 8% college inflation rate means that the cost of college doubles every nine years.

The mission of CollegeInvest was to be Colorado’s higher education financing leader and to help Colorado families break down the financial barriers to college. Those barriers just got another reinforcement. Even the state has thrown in the towel. Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

Bradford C. Bruner for Sua Sponte Wealth Management