(click to enlarge)

We'll enter earnings season this week. Alcoa will kick it off on Tuesday. The analysis will be a welcome respit from the headline driven distraction of the fiscal cliff and the Washington debates. It will be nice to see how businesses are performing before we enter back into the debt ceiling harangue in late February or March.

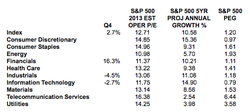

Earnings are expected to be a little better than Q3 results. Analysts forecasts are well down from those made in October of 2012 (see chart). 9.2% to 2.7%. The S&P is coming off its highest close since 12.31.2007. Europe will be back in focus and business leaders have indicated that weak macroeconomic conditions are a renewed area of great concern. Expect continued volatility in the markets.

Earnings are expected to be a little better than Q3 results. Analysts forecasts are well down from those made in October of 2012 (see chart). 9.2% to 2.7%. The S&P is coming off its highest close since 12.31.2007. Europe will be back in focus and business leaders have indicated that weak macroeconomic conditions are a renewed area of great concern. Expect continued volatility in the markets.

(click to enlarge)

We will see if Corporations can continue to boost profits despite weak revenue growth. Above, we saw that earnings growth is projected at 2.7%, revenue growth is forecasted at 1.9%. It will be interesting to see if earnings can expand at a greater clip than top line revenue. Through cost controls, technology, and increased productivity, it has been happening. Possibly at the expense of wages and jobs? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

Bradford C. Bruner for Sua Sponte Wealth Management