(click to enlarge)

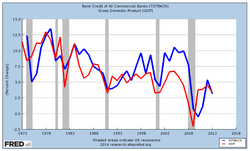

(click to enlarge) You'll notice that economic growth (GDP) is in lock step with credit expansion (Bank Credit). Banks have plenty of money to lend, but loans have slowed down in the past year. The slow down is not the result of a credit crunch, but probably more of a reflection of slowing demand due to caution exercised by businesses and consumers. So, for the economy to accelerate, lending really needs to pick up.

It could also indicate that not all banks have finished cleaning up their balance sheets. Ever since provisions requiring banks to mark their assets to market values were suspended, the assumption has been that banks have been getting rid of bad assets and that the buildup in reserves is due to caution about lending. It may also be that the slow pace of lending and build up in reserves is partly due to the need to put capital against legacy bad assets. The implementation of the Volcker rule, which bans banks from proprietary trading, may mean we will see more of this—and not just from small banks, as it is assumed. Whatever the explanation for weakness in bank credit expansion, this is an indicator worth watching. Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

It could also indicate that not all banks have finished cleaning up their balance sheets. Ever since provisions requiring banks to mark their assets to market values were suspended, the assumption has been that banks have been getting rid of bad assets and that the buildup in reserves is due to caution about lending. It may also be that the slow pace of lending and build up in reserves is partly due to the need to put capital against legacy bad assets. The implementation of the Volcker rule, which bans banks from proprietary trading, may mean we will see more of this—and not just from small banks, as it is assumed. Whatever the explanation for weakness in bank credit expansion, this is an indicator worth watching. Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management