Friday will bring the release of the August jobs report. This is one of the most highly anticipated jobs report in recent memory. It may be the deciding factor in the Federal Reserve's choice to dial back bond purchases starting in the middle of September.

Recent global events have contributed to the uneasiness on Wall Street, but none more than the thought of the Fed reducing the $85 billion monthly stimulus (QE3). Last week, the markets recorded their steepest monthly decline since May of 2012. On one hand, it will be nice to get it behind us. On the other hand, the economy is still just too fragile for the Fed to take any action. Regardless, we expect a make or break signal from the Friday Jobs Report.

Recent global events have contributed to the uneasiness on Wall Street, but none more than the thought of the Fed reducing the $85 billion monthly stimulus (QE3). Last week, the markets recorded their steepest monthly decline since May of 2012. On one hand, it will be nice to get it behind us. On the other hand, the economy is still just too fragile for the Fed to take any action. Regardless, we expect a make or break signal from the Friday Jobs Report.

The Fed meets on September 17th and 18th. From a real economic view, QE3 has benefited the markets and has not had a substantial impact on the economy short of pushing asset values higher. Trickle down anyone?

A strong jobs report will likely reinforce the view the Fed will opt to decrease its bond purchases. Will there be any harm to the real economy by beginning to ease the bond buying, will this signal the end of the bull market?

The S&P 500 index fell 3.1 percent in August; the Dow Jones industrial average lost 4.4 percent and the Nasdaq slipped 1 percent.

A strong jobs report will likely reinforce the view the Fed will opt to decrease its bond purchases. Will there be any harm to the real economy by beginning to ease the bond buying, will this signal the end of the bull market?

The S&P 500 index fell 3.1 percent in August; the Dow Jones industrial average lost 4.4 percent and the Nasdaq slipped 1 percent.

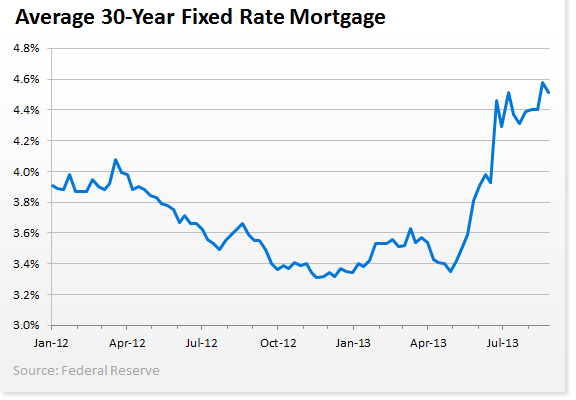

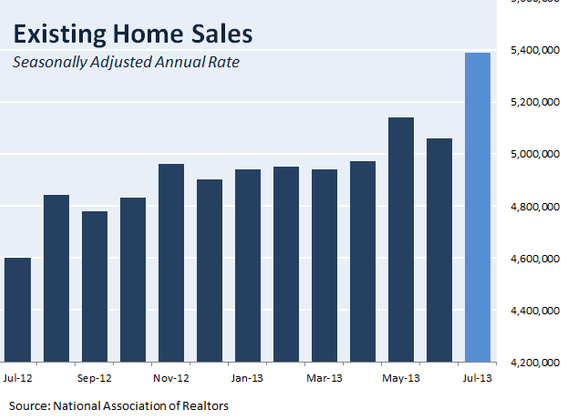

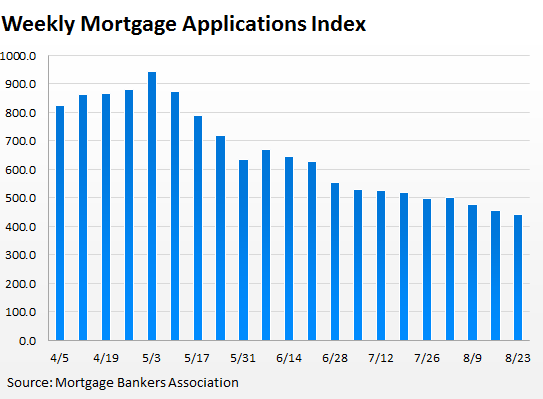

Not only has the timing of the Fed easing resulted in choppy markets, it has triggered a bond market sell-off. Remember that bond prices, and interest rates, move in opposite directions. Mortgage rates are at a two year high and may be showing signs that the housing market is slowing because of the higher costs of borrowing. Are the first time home buyers getting the mortgages? It looks like the majority of purchases are by speculators and all cash transactions. Another side effect of higher rates is to watch the impact escalating rates will have on businesses adding workers.

(click to enlarge)

Current unemployment rate is at 7.4%. If the rate falls to 7.3%, expect the Fed to take some action. Markets can only hope for a disappointing number, the Fed will back away and markets will rally.

Middle East tensions will continue to be in play. We anticipate limited strikes by the US coalition, but for the situation to smolder into the unforeseeable future sending oil prices higher. This week will also bring vehicle sales along with factory and service data. For a short week, it should give us a reasonable view through the end of the quarter. We feel that markets do have room to move lower, a total 10% correction is not out of the question. This is healthy for long term market growth. September has a history of being one of the worst months for stocks and has an ominous anniversary this year - the five year recognition of the worst global economic crisis since the Great Depression. The market dropped over 9% in September 2008.

Middle East tensions will continue to be in play. We anticipate limited strikes by the US coalition, but for the situation to smolder into the unforeseeable future sending oil prices higher. This week will also bring vehicle sales along with factory and service data. For a short week, it should give us a reasonable view through the end of the quarter. We feel that markets do have room to move lower, a total 10% correction is not out of the question. This is healthy for long term market growth. September has a history of being one of the worst months for stocks and has an ominous anniversary this year - the five year recognition of the worst global economic crisis since the Great Depression. The market dropped over 9% in September 2008.

(click to enlarge)

The VIX (volatility index) rose above 17 on Friday, a two-month high. Market volume has been light exaggerating market swings. Other items to watch are: Obama's nominee to replace Ben Bernanke (Fed Chairman), debate over the federal debt. September will be a month where we hope to dial in our economic GPS, but you can count on some misdirection. Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management