(click to enlarge)

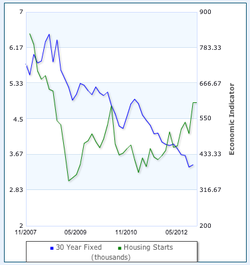

A very important economic indicator is Housing Starts and Building Permits. If any one indicator is a possible precursor to recovery it could be this one. Two aspects of Housing are important drivers.

First, housing is very sensitive to interest rates. Typically, when rates are low activity in home buying increases now that rates make it more affordable. Interest rates have been at an all time low for some time and the Federal Reserve has indicated that they will work to keep rates low going into 2014. Second, the homebuilding industry has a huge impact on the rest of the economy. The multiplier effect is a term used to refer to the increase in demand seen in steel, wood, electricity, glass, plastic, wiring, piping, concrete and labor as a result of an increase in housing demand. Demand for furniture, carpet, electronics, and appliances are also seen increasing.

First, housing is very sensitive to interest rates. Typically, when rates are low activity in home buying increases now that rates make it more affordable. Interest rates have been at an all time low for some time and the Federal Reserve has indicated that they will work to keep rates low going into 2014. Second, the homebuilding industry has a huge impact on the rest of the economy. The multiplier effect is a term used to refer to the increase in demand seen in steel, wood, electricity, glass, plastic, wiring, piping, concrete and labor as a result of an increase in housing demand. Demand for furniture, carpet, electronics, and appliances are also seen increasing.

(click to enlarge)

Housing starts record how much groundbreaking occurred for residential real estate in the previous month. Housing permits are usually required for builders who are planning to construct new homes. Not only can one get a good sense of how many, but also where. An indication of which areas are recovering faster than others.

Housing starts rose by 3.6% to 894,000 in October. This is the highest in over four years. GDP could get a much needed boost from Housing, the first time since 2005. Building permits in October were almost 30% higher than last year at this time.

Housing starts rose by 3.6% to 894,000 in October. This is the highest in over four years. GDP could get a much needed boost from Housing, the first time since 2005. Building permits in October were almost 30% higher than last year at this time.

(click to enlarge)

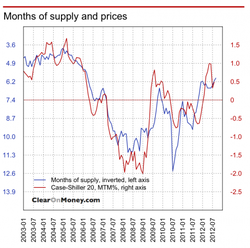

While the current trends in Housing Starts and Building permits look promising, U.S. housing still has a long way to go. The challenge, the dynamic not seen before, is the huge debt burden that 11 million Americans (1/5th of homeowners) are deeply underwater and owe more on their properties than they are worth. This needs to be resolved before the typical housing based economic recovery can begin. Consumers, deep in debt on mortgages, have tended to spend less on cars, groceries, appliances and furniture. Others reduced spending because they lost their homes to foreclosure damaging their credit rating and ability to borrow. The spicket that once was home equity has gone dry. The Federal Reserve has lowered rates to historic lows, but many institutions won’t refinance loans or extend new credit.

While it is a good sign that Housing Starts and Permits are up, too many homes are underwater. Until homeowners are able to get out from underneath the housing debt, Housing Starts will continue to add encouragement that we have turned the corner. How are you feeling, have we turned the corner? Sua Sponte.

Bradford C. Bruner For Sua Sponte Wealth Management

While it is a good sign that Housing Starts and Permits are up, too many homes are underwater. Until homeowners are able to get out from underneath the housing debt, Housing Starts will continue to add encouragement that we have turned the corner. How are you feeling, have we turned the corner? Sua Sponte.

Bradford C. Bruner For Sua Sponte Wealth Management