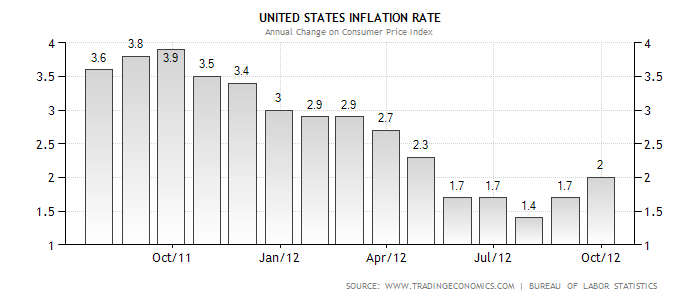

If you do have some money to save, where do you put it? A pass book savings account has an annual percentage yield of around 1%. A five year certificate of deposit can lock in 1.75% if you are lucky. The current inflation rate is 2%, so any of those options will return (real yield) a loss on your investment. Thrifty, frugal savers are in the gulag.

Interest rates reflect the price of money. Central banks want rates low in an effort to encourage corporate investment and consumer spending. Low rates reflect a weak economy. A strong economy calls for higher rates in an effort combat inflationary pressure from rising wages and prices.

When it comes to stocks, and rates are low, the tendency is to move out of cash and into equities in search of a better return. The economy gets a boost when equities rise and the wealth effect comes into play. But if rates remain low and the perception is that future economic growth will be slow, investors may shy away from investing in equities. So, are low rates good or bad for equities?

Interest rates reflect the price of money. Central banks want rates low in an effort to encourage corporate investment and consumer spending. Low rates reflect a weak economy. A strong economy calls for higher rates in an effort combat inflationary pressure from rising wages and prices.

When it comes to stocks, and rates are low, the tendency is to move out of cash and into equities in search of a better return. The economy gets a boost when equities rise and the wealth effect comes into play. But if rates remain low and the perception is that future economic growth will be slow, investors may shy away from investing in equities. So, are low rates good or bad for equities?

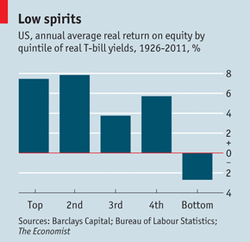

The answer: when real yields (adjusted for inflation) have been negative, equities have risen at a rate of 2.3%; when yields were positive, the average gain was 6.2%.

In this graph, the "bottom" shows the return when real rates were negative, the market declined an average of 2.7%. The "top", shows the years with highest yields, equities gained 7.4% on average. That spread is 10% in favor of positive real yields.

Inflation, in years when the rate has been falling, stocks have had a real return of 9.6%. In years of rising inflation, equities have seen a real return of minus 1.1%. An upward movement of inflation will not be good for stocks. Has our monetary policy put too much money into the economy, fueling inflation? Or is the monetary action still too tight? Leading to continuing weakness in the economy and lower corporate forecasts that could drive equities lower.

Do we think that continued low real rates will light a fire under equities and push them even higher, or are equities already overvalued and low rates are just setting them up for a correction? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

In this graph, the "bottom" shows the return when real rates were negative, the market declined an average of 2.7%. The "top", shows the years with highest yields, equities gained 7.4% on average. That spread is 10% in favor of positive real yields.

Inflation, in years when the rate has been falling, stocks have had a real return of 9.6%. In years of rising inflation, equities have seen a real return of minus 1.1%. An upward movement of inflation will not be good for stocks. Has our monetary policy put too much money into the economy, fueling inflation? Or is the monetary action still too tight? Leading to continuing weakness in the economy and lower corporate forecasts that could drive equities lower.

Do we think that continued low real rates will light a fire under equities and push them even higher, or are equities already overvalued and low rates are just setting them up for a correction? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management