What a week it has been. Eight straight days of advances in the S&P 500. Curb your enthusiasm or maybe just tone it down a little?

What’s happening? Looks like retail investors, that abandoned the market in 2008, are jumping back in. Those that were holding cash, and waiting for a correction, are entering back into the game. $14.9 billion has moved into stocks and mutual funds in the past 3 weeks. This is the best increase since 2001. $6.8 billion moved into domestic stock based mutual funds since the 1st of this year. We have not recovered the $416 billion that moved out of the markets in the period following the 2008 -2009 meltdown, but a significant reversal nonetheless. It has taken some time but it appears the Fed’s plan is working. Keeping interest rates at near zero until unemployment falls to below 6.5%, investors are moving into riskier assets for higher returns, stock prices are rising, the wealth effect comes into play, consumers and corporations will spend; the growth engine has its consumption fuel.

What’s happening? Looks like retail investors, that abandoned the market in 2008, are jumping back in. Those that were holding cash, and waiting for a correction, are entering back into the game. $14.9 billion has moved into stocks and mutual funds in the past 3 weeks. This is the best increase since 2001. $6.8 billion moved into domestic stock based mutual funds since the 1st of this year. We have not recovered the $416 billion that moved out of the markets in the period following the 2008 -2009 meltdown, but a significant reversal nonetheless. It has taken some time but it appears the Fed’s plan is working. Keeping interest rates at near zero until unemployment falls to below 6.5%, investors are moving into riskier assets for higher returns, stock prices are rising, the wealth effect comes into play, consumers and corporations will spend; the growth engine has its consumption fuel.

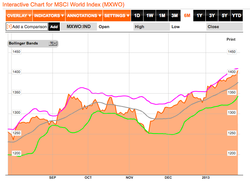

(click to enlarge)

Portfolios of individual investors have been idle for sometime. Holding cash on the sidelines, waiting for a correction, we never seem to learn. Small investor psychology shows us time and time again that we sell and buy at all the wrong times. Selling when the market is spiraling to its murky demise and buying at the all time euphoric highs. No one wants to lose it all, no one wants to miss the rally. This current rally started after the credit lockup of 2008 & 2009, since March of 2009 the S&P has increased 120%. Major indexes are up almost 5% since the beginning of January, breaking past the psychological barrier of 1,500 and on target to hit its all time high of 1,565 set back in 2007. Market confidence appears to be rising. If you’re holding bonds, you are missing out. Where else are you going to go for returns that can outpace inflation? This current trend to riskier assets could definitely hurt the bond investor.

(click to enlarge)

Why all the worldwide optimism? At home there seems to be less doom and gloom. Housing, jobs, and corporate profits appear to be improving. Businesses are able to report solid profits despite flat revenue growth. IBM reported robust earnings in Q4 2012. Earnings per share increased 11%, net income up 6% and all this done while revenue declined by 1%. How? Relentless cost cutting and stock share repurchases.

The government has implemented a short-term fix for the debt ceiling that will take it off the front page for at least a few weeks. Housing appears to be gaining some traction.

Overseas the Central Bank is buying bonds and it appears the single currency will be saved. China’s growth appears to be accelerating with an increase in GDP from 7.4% to 7.9%. Retail sales are up by 15% year over year. Industrial production is up 10%.

The government has implemented a short-term fix for the debt ceiling that will take it off the front page for at least a few weeks. Housing appears to be gaining some traction.

Overseas the Central Bank is buying bonds and it appears the single currency will be saved. China’s growth appears to be accelerating with an increase in GDP from 7.4% to 7.9%. Retail sales are up by 15% year over year. Industrial production is up 10%.

All roses? We think not. Our government has really not solved anything, just moved the pawn on the Parcheesi board. Not realized yet is the rise in the payroll tax which could take 1% out of our fragile GDP number. The aggressive bond buyer strategy may backfire. Global austerity and recession, ever tightening credit and zero growth in Europe are still very real.

The age old question of appearance versus reality. How does it look from where you are, you enthusiastic and jumping in or curbing your enthusiasm. Still pretty, pretty skeptical? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management

The age old question of appearance versus reality. How does it look from where you are, you enthusiastic and jumping in or curbing your enthusiasm. Still pretty, pretty skeptical? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management