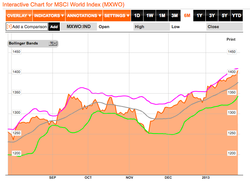

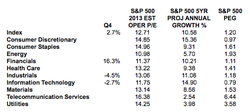

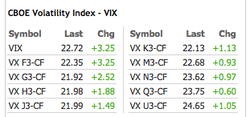

The S&P 500 hit an all time high on Tuesday, and then proceeded to close the week down 1.31%. We are in for some volatility as we enter earnings season.

We have yet to see the impact of sequestration and austerity. Government spending cuts will create a drag that will begin to be felt at the end of April through June. Workers will begin to take days off without pay, things could get very ugly. The fiscal drag will keep unemployment high and job growth will remain slow.

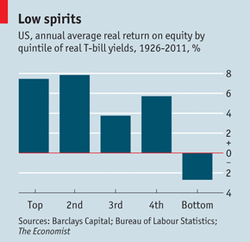

It's a catch 22 that will go on for sometime. Revenues will be tight, companies will not hire, earnings will be accomplished by bottom line growth. No hiring, no economic growth. No hiring, no Fed easing. No Fed easing, more low interest rates. Continued low interest rates, markets continue to rise. Where else are you going to go for returns? You can not sit on the sidelines for another 36 months. When hiking, are you willing to backtrack 250 VF to ascend for 1,000 VF? Sua Sponte.

Bradford C. Bruner for Sua Sponte Wealth Management